Create and maintain budgets

The first step in avoiding the hassle of financial debt is creating and maintaining a budget. It's not as scary as it sounds, don't worry.

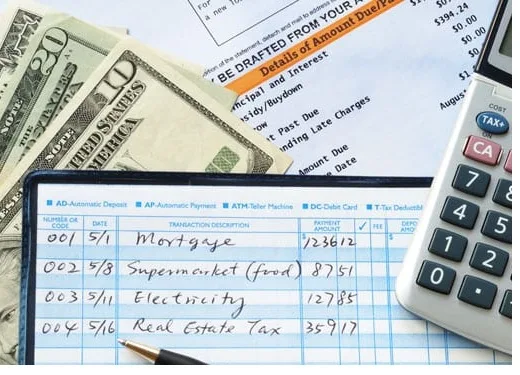

First, make a list of all your monthly income along with your monthly expenses. When determining income, list all sources, including alimony, child support, side jobs, etc. When calculating expenses, be sure to include housing, food, transportation, utilities, entertainment, and more. To accurately reflect actual expenses, sit down each evening and write down your expenses, making sure to keep your receipts. Determine if your income can cover all expenses. If the answer is no, then some expenses need to be reduced.

Adjust spending. If the difference is small, it may mean reducing some small expenses, such as entertainment or cell phone plans. If the deficit is larger, you may need to downsize your vehicle or living arrangements. If your income is enough to cover all your expenses, you may still want to cut back on some unnecessary spending habits. This frees up extra money for things like vacations or your kids' college funds.

Also, consider whether you need to add new categories. Some areas that are often overlooked are debt relief, emergency savings funds, and retirement savings. An emergency fund ensures that there is enough money to cover unforeseen events (car emergencies, etc.), should they occur. This will eliminate the need to use credit, which can quickly damage your budget.

Sticking to a budget has several benefits. First, most people set financial goals that they want to achieve in the future. Sometimes it might be a trip, a brand new car, or a college education. A budget can help people save money to achieve these goals. Additionally, many are saddled with high levels of consumer debt. It is almost impossible to make much progress in reducing debt without disciplined spending patterns. A personal budget will provide the necessary framework to start eliminating these ballooning account balances.

When executed properly, a budget will allow a person to meet their expenses, put money into savings, and pay off outstanding debts all at the same time. Therefore, it is in anyone's best interest to create and implement a budget.

cut the expenses

Limiting spending and sticking to a budget may seem difficult at first, but you can make some practical changes every day that will cut your spending even more than you expected.

First, change credit card behavior. Start paying cash whenever possible. This will help you avoid buying unless you really have the money. If you decide to buy with a credit card, be prepared to pay off the balance each month. This will save a lot of money by avoiding interest charges. If you already have a credit card balance, move to a card with a lower interest rate. Also, find a card with no annual fee.

Another tip is to pack a lunch every day. All lunchtime spent at restaurants adds up. Bringing your own lunch can save you a few dollars a day, and it adds up over time.

Use your phone during off-peak hours. Some people spend hundreds of dollars a month on phone bills. Avoid this by making most of your calls during off-peak hours. Check your service and plan to find out when you can make cheap or unlimited calls.

Don't throw away the Sunday paper before viewing the ad. Clip some of these coupons and check out the sales. This may seem tedious, but the savings are usually worth it. Many stores will double or triple the amount of the coupon. This technique can save you up to $20 or $30 every time you go to the grocery store.

Also, refinance. Mortgage rates have been extremely low over the past year. This is a great opportunity to drastically reduce your monthly home payment. If you plan to pay off your home before retirement, you may want to take this into account before refinancing.

Finally, bundle your insurance. Many insurance companies offer their customers lower rates if they purchase multiple policies. For example, some people use the same proxy for multiple cars, while others combine their cars and houses. Always remember, a dollar here and there really starts to add up. Avoid the idea that changing your spending habits won't save you that much money.

Start saving!

So you're saddled with bills to pay each month and wondering how to start a savings account to cover emergencies and other high-cost endeavors. In other words, where can you find extra cash for later?

Firstly, when configuring your budget, plan for your savings first. You will grow richer each month if you begin to pay yourself first. Before paying any bills, decide on a set amount that you will pay yourself first—maybe five or ten percent— or whatever you decide—of your paycheck. Then, deposit the amount into a savings account before paying any bills.

When you do this at the beginning of the month, your entire paycheck will not suddenly slip through your fingers. If you wait until the end of the month, there may be nothing left to save. Paying yourself first will give you a systematic way to make your money grow. Regardless of your profession or your income, this system will work if you stick to it.

Another technique you may try for saving money is to empty your extra change into a coffee can or a jar each day. At the end of the month, roll the coins and put them into your savings account. You may be able to save 30 or 40 dollars each month just with your spare change.

Remember that good money management is more than just a mathematical formula. It's too closly tied with the ups and doubled to be just that. Your Money Manag EMENT PLAN is Always Subject to Change If Your Life Situation Changes. The Object of a Good Budget is to make your money go the farthest in helping you reach your goals, it is not there to force to you to abide by rules.

Don't get discouraged if the budget plan doesn't work perfectly right away. It may involve some revising and editing until it fits your needs. Then, make sure to review it often, and be sure it is making the best use of every penny! Because we know how helpful those spare pennies can be!

Avoid Spending Pitfalls!

With all the advantages that are evident from personal budgeting, it is no wonder that more and more people are relying on them to reduce debts and increase their savings. However, all 'budgeters' need to be careful to avoid some common pitfalls that appear often .

Credit cards may seem like small pieces of plastic, however they can cause a great deal of trouble for the owners. It is common for people to make unwise purchases, which they would have avoided otherwise, because they had the credit card in their wallet. The best solution for many people is simply to get rid of credit cards and begin paying only by cash, check, or debit cards. You may want to keep one card handy for emergencies, but it is probably best to keep it out of reach, and far away from your wallet.

Another problem with budgeting is impatience. There are financial goals set, but people do not have the patience to complete a savings program. For instance, an individual begins setting aside money for a new car; however, after a few months they discover the car of their dreams. Rather than waiting, they make the purchase. This could pose some serious financial strains. Discipline is a must to prevent impatience from breaking your budget.

Once a person makes a budget, they often fail to adjust it when necessary. A budget is created using a set of expenses and income figures that are liable to change. As these figures do change, it is important that the budget changes to reflect the adjustments. There could be some major deficits if this is not done appropriately and promptly.

Of course nobody forgets about Christmas or Hanukkah, however many people do not consider budgeting for holidays when creating a budget. Therefore, adequate funds have not been set aside for presents, food, parties, etc. These items should be factored in and s saved for throughout the year.

Finally, many people factor in transportation and accommodations for vacations in their budget, however they underestimate money needed for food, entertainment, and spending money. Keep in mind that all the resorts and tourists areas are double or triple what you would normally pay .

With a little planning, you'll be on your way to saving more money than you ever thought possible!

Easy Money-Saving Changes

One of the most obvious and easy ways to save some extra cash is to change some of the way you use products and items in your everyday life. The key is to make minor changes.

For instance, always buy the cheapest hand soap you can find. The quality doesn’t necessarily go up with the price and you can use it in place of ‘bath soap.’

Always use the whole product. Turn bottles upside down and drain to get the last bit from them. Tear open sugar and flour sacks to get everything; squeeze or cut open tubes to use it all before running out to buy more. surprised at how much there really is left!

Also, never use more than you need. Just because it says on the box that you need a full cup, doesn't mean that you really do it need it. Half a measure of laundry detergent and a half teaspoon of dish soap are examples of what are usually enough, r

ather than what the manufacturer says.

To save some cash, you can use some of the things in your house in some unique ways. Instead of spending lots of money on the fancy floor cleaners, try using ammonia. It does a great job, and you can use plain water in between times. If your furniture needs some polishing, mix equal parts of white vinegar and vegetable oil and rub on the furniture. Buff with a cloth until it shines.

For a freezer bag, use empty chip bags and close with masking taps. Also try a bowl with a lid, such as a margarine tub.

If your skin is feeling a little dry, there are several substitutes for expensive lotion. Petroleum jelly rubbed into your hands at night after a warm water soak, mayonnaise (rinse w/ cold water after), or any other oil based food. Just be sure to put it on immediately after your hands have been in water.

To save some money on laundry, dissolve a bar of handsoap in water to replace laundry detergent. Add three gallons of hot water, mix thoroughly and add a cup of washing soda.

Sure, these are small changes, but added up, they can put some extra change into your pocket throughout the year!